- National Highways Authority of India (NHAI) chooses London for first global offshore Masala bond, raising INR 30 billion (USD 467 million equivalent)

- Minister of Road Transport & Highways and Shipping Shri Nitin Gadkari is hosted at London Stock Exchange

- Confirms London Stock Exchange’s position as leading international listing venue for Indian finance

- London Stock Exchange today welcomes the first global offshore Masala bond by the National Highways Authority of India (NHAI). The landmark bond issuance from NHAI, the Government of India’s agency responsible for the management of India’s highways network, reinforces the ability of London’s global Masala bond market to support Indian infrastructure financing. The bond marks the largest ever five-year issuance and is the largest inaugural transaction in the Masala bond market, demonstrating London’s increasingly global investor base.

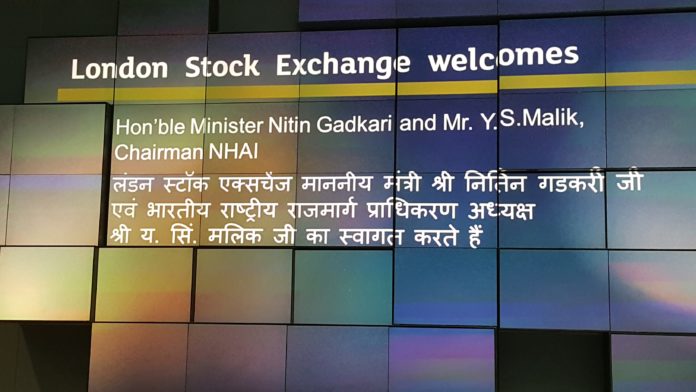

Nikhil Rathi, CEO, London Stock Exchange plc welcomed Minister of Road Transport & Highways and Shipping Shri Nitin Gadkari, together with NHAI representatives at London Stock Exchange today. Minister Gadkari addressed guests on the Government of India’s initiatives in infrastructure and opportunities for investors to participate in India’s growth story.

The 60 month dated Rupee denominated bond, commonly known as a Masala bond, raised INR 130 billion, equivalent to USD 467 million, with an annual yield of 7.3%. The issuance secured global investor backing and will support Prime Minister Narendra Modi and Minister Gadkari’s plans to accelerate infrastructure investment across India. The listing follows Prime Minister Modi’s announcement of USD 1 billion equivalent of Masala bond issuance in the UK, made during his visit to London in 2015.

London Stock Exchange has a strong track record of supporting Masala bond issuance by supranational, municipal and private company institutions on its markets. To date in 2017, there have been five Masala bond listings in London, raising USD 135 million equivalent. In total, 39 Masala bonds have listed on London Stock Exchange, raising equivalent to approximately USD 5.4 billion

Minister of Road Transport & Highways and Shipping Shri Nitin Gadkari:

“Our Government is fully committed to bridge the infrastructure deficit in the country. Prime Minister Shri Narendra Modi, Finance Minister and I are on the same page on this and we firmly believe that consistent high level public investment in transport infrastructure including Highways, Ports, Airports and Railways is going to accelerate the economic growth in the country. Improvement in the quality of connectivity across the length and breadth of India will help us achieve the vision of our Government of ‘Sabka Saath Sabka Vikaas’”.

Mr Yudhvir Singh Malik, Chairman, NHAI:

“National Highways Authority of India is committed to implement the Government’s vision of delivering high quality highways infrastructure in the shortest possible time. As you would appreciate, National Highways act as force multipliers in the overall economic growth of the country and NHAI plays a critical role therein. We are fully aligned to the aspirational program and expectations of the Government in this endeavour in the coming years.”

Nikhil Rathi, CEO, London Stock Exchange plc & Director of International Development, London Stock Exchange Group:

“We are honoured to welcome Minister Gadkari to London Stock Exchange and warmly congratulate NHAI on their successful bond listing today. It is a significant achievement for NHAI and London’s capital markets. It underlines the vital new international channel of funding that is open for Indian issuers in London and the strength of international investor interest in building exposure to India’s growth story.

“London Stock Exchange, the global home for Masala bonds is proud to be the partner of choice for NHAI as it embarks on its journey to accelerate infrastructure investment across India. NHAI’s infrastructure programme, the largest in the world , has attracted global investor support through London – testament to the City’s status as a global financial centre and a strong partner to India.”

NHAI’s bond listing is the latest in a long line of global firsts for London Stock Exchange Group, including numerous high profile Rupee denominated bond issuances on London Stock Exchange over the past 24 months.

Readers like you, make ESHADOOT work possible. We need your support to deliver quality and positive news about India and Indian diaspora - and to keep it open for everyone. Your support is essential to continue our efforts. Every contribution, however big or small, is so valuable for our future.